Theme 3: Fairness in TaxesLesson 5: How Taxes Affect Us

In the United States there are progressive income taxes, a regressive Social Security tax, and a variety of local property taxes, excise taxes, and user fees that are somewhat regressive. Taxpayers over a wide range of income levels end up paying roughly the same percentage of their incomes in taxes. Although no single tax is proportional, the combination of different taxes creates a roughly proportional system. Vertical equity is the concept that people in different income groups should pay different tax rates.

|

materials:Activities

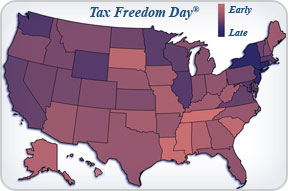

Activity 1: Fairness and Taxes How do taxes in a regressive, progressive, and proportional tax system affect income? Activity 2: Tax Freedom Days How many calendar days does it take to make enough money to pay your total tax liability? Activity 3: Tax Your Memory Is your memory taxed? Play this matching game to find out. Assessment

Complete the assessment page to check your understanding of How Taxes Affect Us. |

| quick check |

|

What is the term used for the idea that people in different income groups should pay different amounts of taxes, or different percentages of their incomes as taxes?

|

| tax trivia |

|

Did You Know?

In the South, some citizens once had to pay a poll tax in order to vote. Often, African Americans and those with low incomes could not afford to pay the tax and were therefore denied the right to vote. The Twenty-fourth Amendment declared the poll tax requirement unconstitutional.

Test your tax trivia knowledge by answering the following multiple-choice question. Click on the correct answer. To assess your answer, click the Check My Answers button. |