Theme 4: What Is Taxed and WhyLesson 2: Taxes in a Market Economy

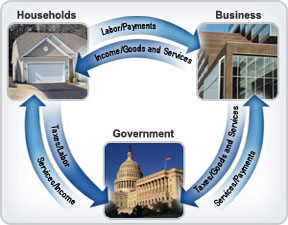

In the United States market economy, there are three sectors, or elements, that interact: households, businesses, and the government. Economists use the circular flow model to explain the interaction among these three sectors. Each sector of the economy contributes to another.

|

materials:Activities

Activity 1: The Circular Flow of Economy Study the circular flow of economy to discover the relationship between the government, businesses, and you. Activity 2: Taxing Times Calculate the amount of taxes owed by individual taxpayers. Activity 3: Income Tax Revenue Take a virtual field trip to learn about changes in income and income tax revenue. Activity 4: Consumer Spending Patterns Take a virtual field trip to learn more about consumer spending in the 1990s. Assessment

Complete the assessment page to test your understanding of Taxes in a Market Economy. |

| quick check |

|

What three sectors contribute to the United States economy?

|

| tax trivia |

|

Did You Know?

Historically, market economies periodically suffer short periods of high unemployment. During the 1930s, the Great Depression seriously slowed the economy of the United States. Millions of Americans were out of work during that time.

Test your tax trivia knowledge by answering the following multiple-choice question. Click on the correct answer. To assess your answer, click the Check My Answers button. |