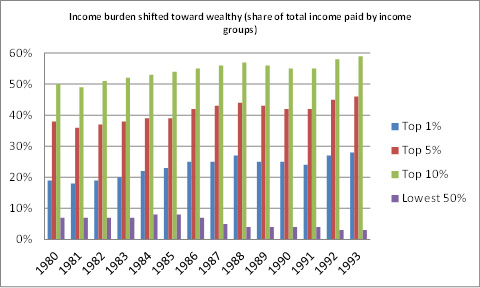

It is interesting to see how much of our total income goes to pay taxes. Take a virtual field trip to learn more about how much of taxpayers' incomes were paid in taxes during the 1980s, the time when one significant tax reform act was enacted.

Visit the Joint Economic Report Committee site to begin your trip. Read the report, "The Reagan Tax Cuts: Lessons for Tax Reform," paying close attention to the bar graph. When you return, answer the questions below. These questions are based on the 1996 finance report from the Joint Economic Committee.

Question/s

"Answer the following multiple-choice questions by clicking the correct answer. To assess your answers, click the Check My Answers button at the bottom of the page."

~ Tina the Tax Tutor

1) How much did the top one percent of taxpayers pay in taxes in 1980?

2) How much did the top one percent of taxpayers pay in taxes in 1988?

3) How much did the top five percent of taxpayers pay in taxes in 1982?

4) How much did the top five percent of taxpayers pay in taxes in 1987?

5) How much did the lowest fifty percent of taxpayers pay in taxes in 1981?

6) How much did the lowest fifty percent of taxpayers pay in taxes in 1988?