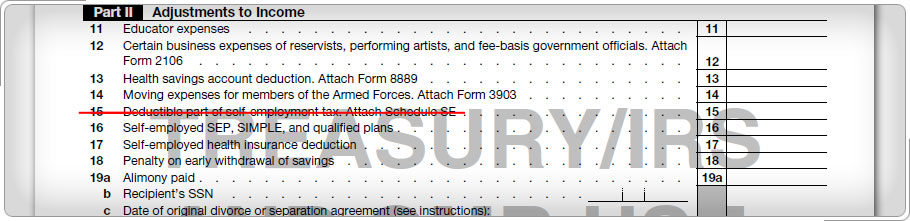

Adjustments to Income (continued)

Self-Employment Tax Deduction

Individuals who do not have a U.S. tax filing requirement, but have self-employment income connected with a trade or business in Puerto Rico:

- Must file Form 1040-SS (SP) (Spanish Version) U.S. Self-Employment Tax Return (Including the Refundable Child Tax Credit for Bona Fide Residents) or Form 1040-SS U.S. Self Employment Tax Return to report their self-employment income

- May have to pay self-employment tax

- Must file Schedule C and Schedule SE

Individuals who have to file a U.S. Individual Income Tax Return and have self-employment income connected with a trade or business in Puerto Rico:

- Cannot take the self-employment tax deduction on Schedule 1, line 15 because this deduction is related to excluded income

- File Schedule C and Schedule SE with their U.S. Individual Income Tax Return (Form 1040 or Form 1040-SR)