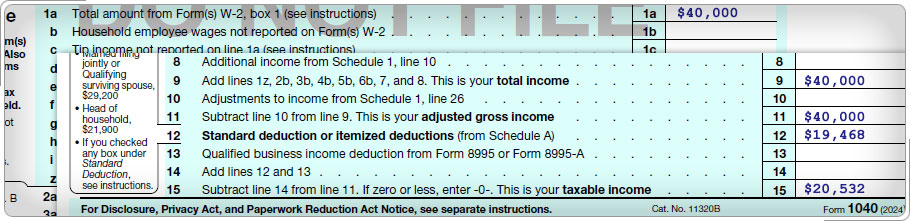

Calculating the Allowable Portion (continued)Case Study (continued)Take a moment to look at Antonio and Sofia's worksheet entries.

You could also have computed their adjusted standard deduction as follows: ($40,000/$60,000) x $31,500 = $21,001

|

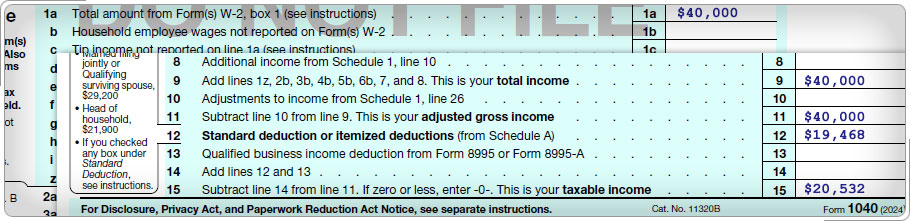

Calculating the Allowable Portion (continued)Case Study (continued)Take a moment to look at Antonio and Sofia's worksheet entries.

You could also have computed their adjusted standard deduction as follows: ($40,000/$60,000) x $31,500 = $21,001

|