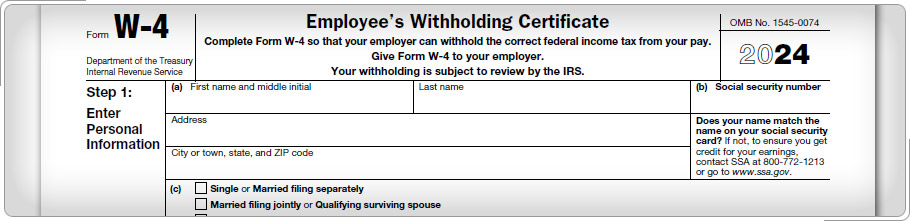

Case Study 2: Form W-4John has two full-time jobs. He reviews his withholding and realizes he will not have enough tax withheld. He gives his employer a revised Form W-4 to increase his withholding so he will not owe money when he files his return. Click here for an explanation. In some situations, getting the right amount withheld is difficult, such as when the taxpayer has more than one job. Publication 17, Tax Withholding and Estimated Tax, has more information on this topic. Taxpayers can use the Tax Withholding Estimator on www.IRS.gov to calculate the correct withholding amount.

|