|

Tax Form and Publication Changes

- Taxpayers will receive Form 1099-K, Payment Card and Third-Party Network Transactions, when reportable proceeds exceed $2,500 for 2025, although they may receive the form at a lower amount. This threshold applies to third party settlement organizations. Taxpayers are required to report all taxable income on their federal income tax return, regardless of amount or if an income reporting document is received.

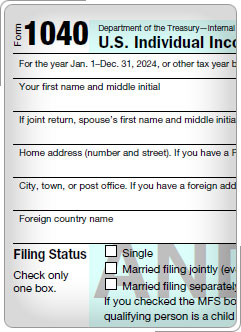

- Form 1040, U.S. Individual Income Tax Return

- Created entry spaces for "Deceased" for both primary taxpayer and spouse and added a separate line for other special processing write-ins.

- Checkbox added for taxpayers (and spouse if MFJ) whose main home was in the U.S. for more than half of 2025.

- The Dependents section was overhauled to provide more information on qualifying children and dependents who would qualify the taxpayer to claim the EIC, CTC, ACTC, or ODC.

- Checkbox added for taxpayers whose filing status is MFS or HoH to check if they meet the requirements for the special rule for claiming the EIC.

- Checkbox added for those taxpayers who don't want to receive the EIC and ACTC.

- Schedule 1 (Form 1040), removes the requirement for taxpayers to manually write in certain information.

- Part I, Line 4 Added checkboxes for Forms 4797 and 4686 to replace "F4684" write-in.

- Part I, Line 7 Added checkbox and entry space to replace "Repaid" unemployment write-in.

- Part II, Line 14 Added checkbox to replace "Storage" write-in that indicates no Form 3903 is required.

- Part II, Line 20 Added checkbox to replace "D" write-in for married filing separately and lived apart from spouse all year.

- Forms 1099-R, new code Y added for box 7 to identify a qualified charitable distribution.

- Form 5405, Repayment of the First Time Homebuyer Credit, and its instructions will be made historical. The form cannot be filed for 2025.

- Form 5695, Residential Energy Credit, Part II now requires taxpayers claiming the credit to include the unique qualified product identification number (PIN) assigned by a qualified manufacturer (QM) for specified property placed into service after 12/31/24.

- Schedule 1-A, Additional Deductions (Form 1040), added due to H.R. 1, One Big Beautiful Bill Act (OBBBA), includes deductions for the following OBBBA tax provisions:

- Enhanced Deduction for Seniors

- No Tax on Car Loan Interest

- No Tax on Overtime

- No Tax on Tips

|