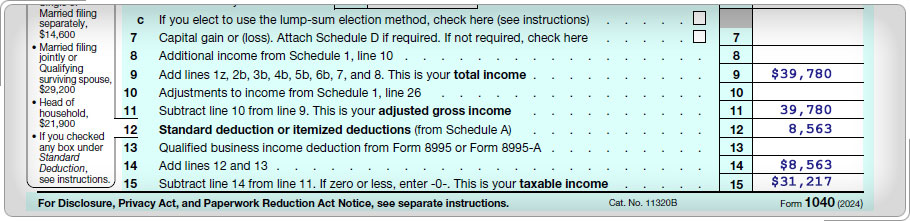

Calculating the Allowable Portion (continued)Case Study (continued)Take a moment to review the allowable portions of Juan and Judith's itemized deductions and their Schedule A.

Think about it: Based on Juan and Judith's information, they can claim either the allowable portion of the itemized deduction $8,563 or the allowable portion of standard deduction $21,130 ($31,500 x 0.6708), whichever is greater. If you elect to itemize deductions even though they are less than standard deduction, check the box on line 18 of Schedule A.

|

|||||||||||||||||||