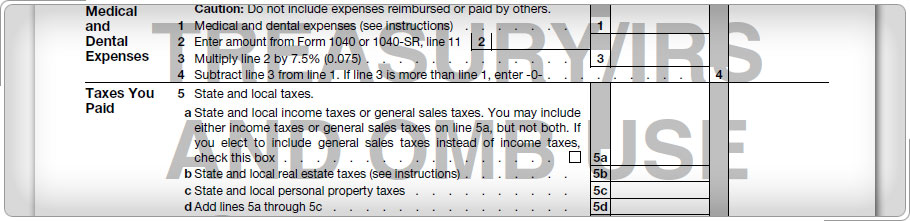

Allowable PortionFor Puerto Rican filers who itemize, the itemized deductions must be allocated based on total gross income from all sources (including Puerto Rico source income). This allocation decreases each itemized deduction. Use the following formula to calculate the allowable portion of a deduction for each itemized deduction. Enter the allowable portion on the taxpayer's Schedule A. For more information, see Publication 1321. Formula

NOTE: Round all fractions to four places. The numerator of the fraction is the gross income subject to the U.S. tax and the denominator is the total gross income from all sources.

|