When Are Benefits Taxable? (continued)

Income Calculation

When calculating the taxable portion of taxpayers' Social Security benefits, compare the base amount to the total of:

- Income excluded under Internal Revenue Code (I.R.C.) Section 933 received by Puerto Rico residents such as: wages (including for services performed in Puerto Rico); interest (including excluded interest); ordinary dividends; taxable amount of IRAs; taxable amount of pensions and annuities (without considering the exclusion allowed in Puerto Rico); alimony received unemployment compensation; and taxable amount of: business income, capital gains, income from rental real estate, royalties, partnerships, S corporations, and trusts, farm income; other income, etc.

- Amounts from Form 1040, lines 1, 2b, 3b, 4b, 5b, 7 and 8, plus line 2a (excluded interest)

- Half their:

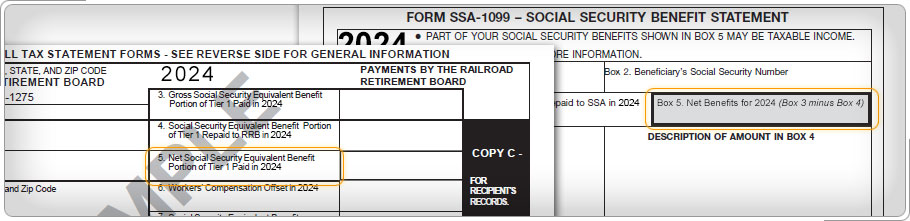

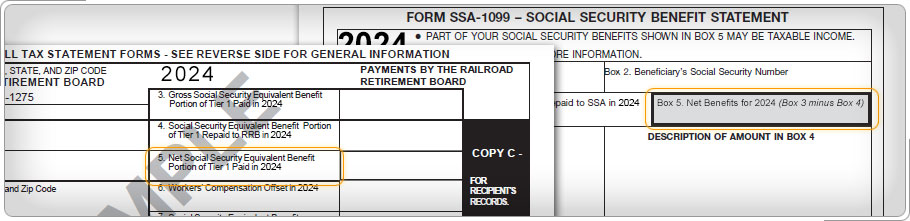

- Social Security net benefit for the year (from Form SSA-1099, box 5)

- Social Security equivalent of the Railroad Retirement Benefits (from Form RRB-1099, box 5)