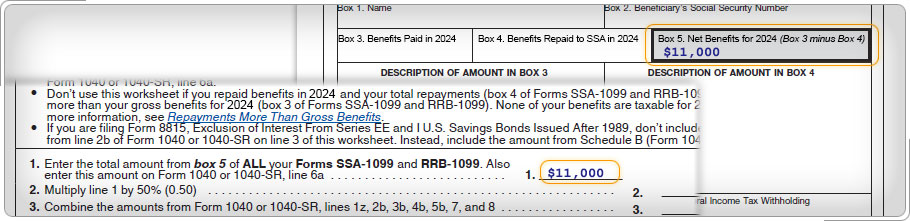

Figuring Your Taxable Benefits WorksheetResidents of Puerto Rico with excluded Puerto Rico source income must use the worksheet in Publication 915 to calculate the taxable portion of Social Security benefits, not the worksheet included with Form 1040's instructions. Social Security benefits are reported to taxpayers on Form SSA-1099, Social Security Benefit Statement. Enter the amount from box 5 of each of the Form(s) SSA-1099s for the taxpayer (and spouse, if filing jointly) on line 1 of the Figuring Your Taxable Benefits worksheet in Publication 915, Social Security and Equivalent Railroad Retirement Benefits. Return the SSA-1099s to the taxpayers for their records.

|