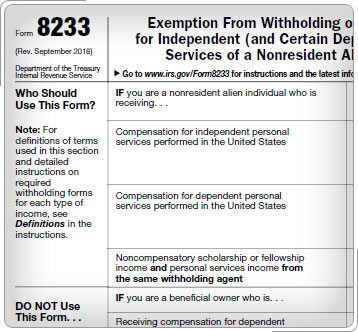

Form 8233International students and scholars who qualify should complete Form 8233, Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual, annually and give it to their employer. This allows employers to avoid withholding federal income tax on the students' and scholars' earnings until the applicable treaty benefit amount is exceeded. Students and scholars are entitled to claim treaty benefits on their tax returns even if they did not give the proper forms to their employer or college, or if the employer did not issue the correct reporting document. In some cases, the student/scholar may have failed to file Form 8233 timely. In this case, they may be issued a Form W-2. However, this does not prevent them from taking advantage of their treaty benefits.

|