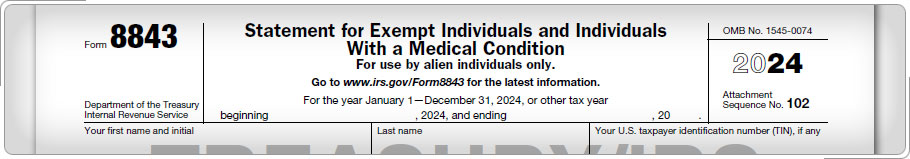

Spouse and Dependent Filing RequirementsSpouses and dependents in J-2 immigration status, who are authorized to work, file Form 8843 and Form 1040-NR. Spouses and dependents who enter the U.S. in J-2 immigration status and are permitted to work, must pay into Social Security and Medicare. They cannot file to have their Social Security tax refunded. If they do not have a filing requirement for Form 1040-NR, then they will only need to file Form 8843. A Form 8843 is filed to explain the basis of a claim that an exempt nonresident can exclude days of presence in the United States for purposes of the substantial presence test.

|