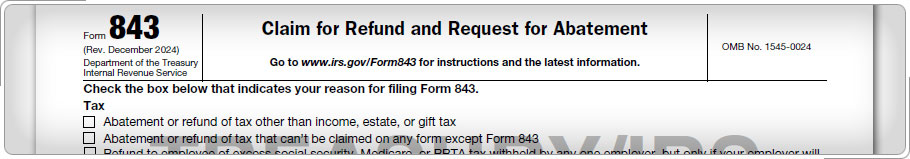

Errors in WithholdingOccasionally, a nonresident alien's employer withholds Social Security and Medicare taxes from pay that is not subject to the taxes. When this happens, the nonresident alien employee should first contact that employer for reimbursement. The employer can amend their employment tax return(s) to get back the employee and employer Social Security and Medicare taxes paid to the IRS. After an attempt is made to receive the Social Security taxes from the employer, if the employer does not refund the withheld taxes, the taxpayer can file a refund claim on Form 843, Claim for Refund and Request for Abatement. The completion of Form 843 and corresponding Form(s) 8316 are Out of Scope for the VITA/TCE Foreign Student and Scholar program.

|