Case Study 1: Form 1040Kelly enjoys collecting stamps as a hobby during her leisure time. Her hobby does not qualify as a business activity for income or profit. Click here for an explanation. An activity qualifies as a business if the primary purpose for engaging in the activity is for income or profit and the taxpayer is involved in the activity with continuity and regularity. For example, a sporadic activity or a hobby does not qualify as a business.

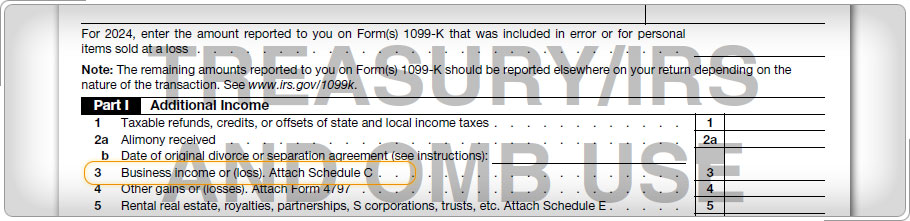

|