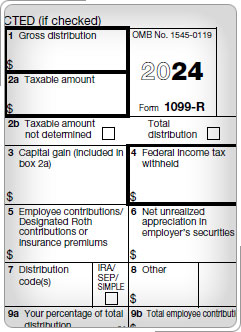

Form 1099-R SeriesThe 1099 forms indicate information such as the amount received, the taxable portion, and the taxpayer's cost (investment) in the plan.

Click here to review Form 1099-R, Pension and Annuity Income, in the Volunteer Resource Guide, Tab D, Income for software entries. Be sure to note the different IRA distribution codes that may be found in box 7.

|

Income — Retirement Income Workout

Workout Resources

Pub 4491, Retirement Income Lesson