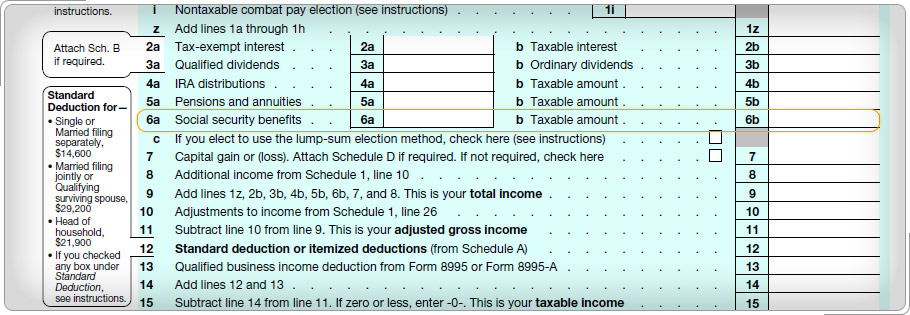

Case Study 1: Taxable Social Security BenefitsWanda and Dan are both retired and will file a joint return. Wanda received Form SSA-1099 with $4,300 in box 5. Dan retired from the railroad and his Form RRB-1099 shows $6,800 in box 5. Wanda and Dan will use the combined benefits of $11,100 and only one calculation to determine if any of their benefits are taxable. Click here for an explanation. If taxpayers are filing a joint return, enter the amounts from each Form SSA-1099 and the software will compute the portion that is taxable, if any.

|