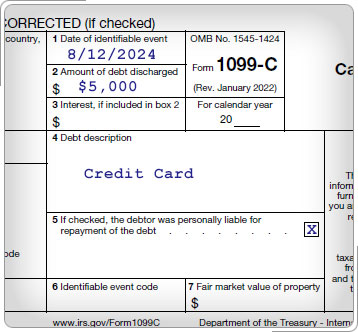

Case Study 1: Cancellation of Debt—Nonbusiness Credit Card DebtJohn made a deal with his credit card company to pay $2,000 on his $7,000 balance, and the company agreed to take it as payment in full. In January, John received a Form 1099-C from his credit card company reporting $5,000 (the amount of debt canceled). John was solvent immediately before the debt was canceled. John must include the entire $5,000 as other income on his tax return. Click here for an explanation. Lenders and creditors are required to issue Form 1099-C if they cancel a debt of $600 or more. Generally, if a taxpayer receives Form 1099-C for canceled credit card debt and was solvent (assets greater than liabilities) immediately before the debt was canceled, all the canceled debt will be included on the tax return as other income.

|