Case Study 2: Combat Pay

Here's how a volunteer helped a taxpayer whose husband had combat pay:

| VOLUNTEER |

|

MRS. FANNIN |

|

| Let's talk for a minute about where your husband was stationed. |

|

My husband was in a combat zone for part of the year. Do I need to tell you the dates or anything? |

|

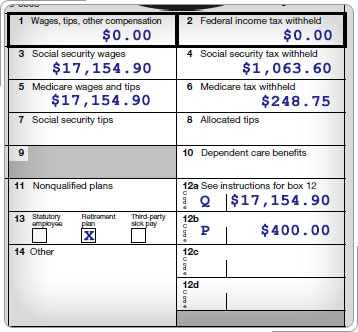

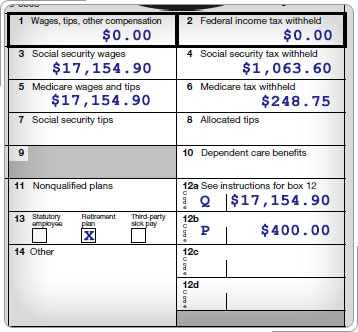

| The combat pay is not taxable, but it's shown on your husband's W-2, here in box 12, with Code Q. I will enter that into the system with the rest of the W-2 information because combat pay can increase some tax credits. I can show on the tax return that he was in the combat zone, but I don't need to know the exact dates. Is he serving in Iraq? |

|

That's right. |