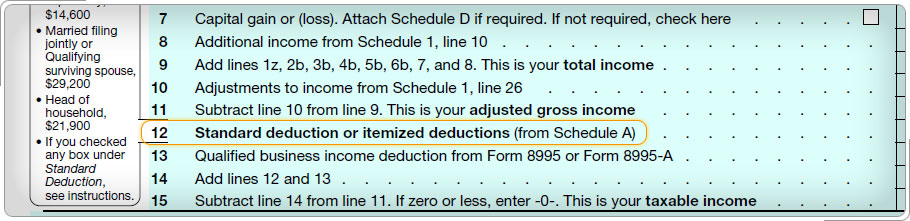

Case Study 2: Who cannot take the standard deduction?Chase files as Married Filing Separately. Her spouse, Grant, will be itemizing his deductions. Chase cannot use the standard deduction; she must itemize her deductions. Click here for an explanation. Some taxpayers cannot take the standard deduction and must itemize. During the interview, find out if the taxpayer is filing as Married Filing Separately and the spouse itemizes. In this situation, the taxpayer must itemize personal deductions and the appropriate box on Form 1040 must be checked.

|