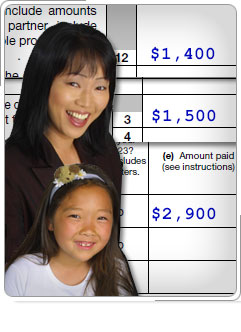

Case Study 1: Employer-provided Dependent Care BenefitsPaula has one dependent child, Jenny, who is six years old. She paid $2,900 in qualified expenses. Paula's Form W-2, box 10, shows she received $1,400 during the year from her employer's dependent care assistance program. After completing Part I of Form 2441, which part of Form 2441 does Paula need to complete next? Click here for an explanation. Because she received dependent care benefits, Paula must complete Part III, Dependent Care Benefits, before completing Part II, Credit for Child and Dependent Care Expenses on Form 2441.

|

Credit for Child and Dependent Care Expenses Workout

Determining the Amount of the Credit

Form 2441