Case Study 1: American Opportunity CreditMindy's brother, Jim, started college in 2022. He was eligible for the American opportunity credit for 2022, 2023, 2024, and 2025. His parents claimed the American opportunity credit on their 2022, 2023, and 2024 returns. Jim claimed the credit on his 2025 tax return. Since the credit has been claimed for four years, the credit can't be claimed on any additional returns based on Jim's expenses. Click here for an explanation. The American opportunity credit is available for the first four years of college per eligible student (generally, freshman through senior years).

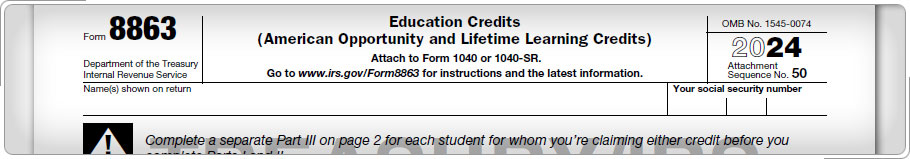

|