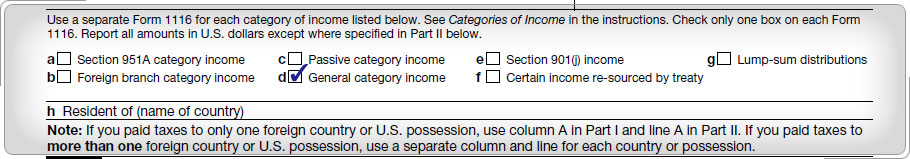

Case Study 2: General Category IncomeBrenda is a U.S. citizen who lives in a foreign country and pays 45% income tax on her interest income in that country. She can list this income as general category income on Form 1116, since the rate of income tax paid on this passive income is higher than the highest U.S. income tax rate. Click here for an explanation. Passive category income may qualify as general category income if the foreign government taxes it at a rate higher than the highest U.S. tax rate. Therefore, if taxpayers pay more than the highest U.S. income tax rate on the foreign source passive income for which they claimed the credit, the credit is computed as general category income.

|