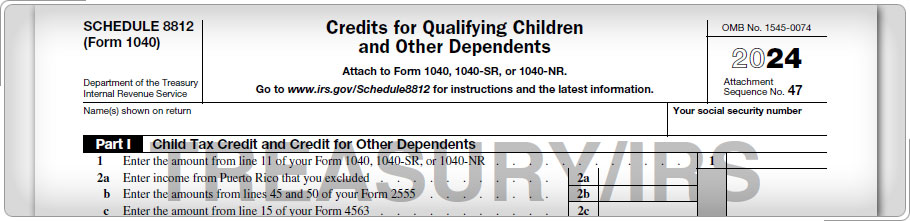

Case Study 1: Figuring the CreditMay and Bob file as Married Filing Jointly and have two children who qualify for the child tax credit. Their MAGI is $56,000 and their tax liability is $954, which is less than the threshold limit for a married couple who files a joint return. What is the maximum amount that May and Bob can claim for the child tax credit? Use Schedule 8812 to determine your answers. Click here for an explanation. If May and Bob's tax liability is $954, they can only claim $954, reducing their tax to zero. In this case, Bob and May may be eligible for the additional child tax credit.

|