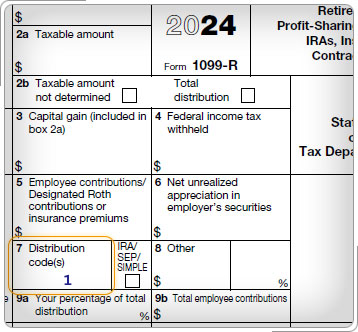

Case Study 1: Distributions, Pensions, and AnnuitiesJohn, who is 39 years old, received Form 1099-R with code 1 in box 7. John has qualified education expenses that he paid during the year. He can reduce the amount of the early distribution that is subject to the additional tax by the amount of qualified education expenses. Click here for an explanation. Qualified education expenses are an exception to the 10% additional tax for early distribution. Also note that John can use the qualified education expenses for another education benefit if he meets those requirements. See the Education Benefits lesson. Qualified individuals that receive coronavirus-related distributions are not subject to the 10% additional tax on early distributions.

|