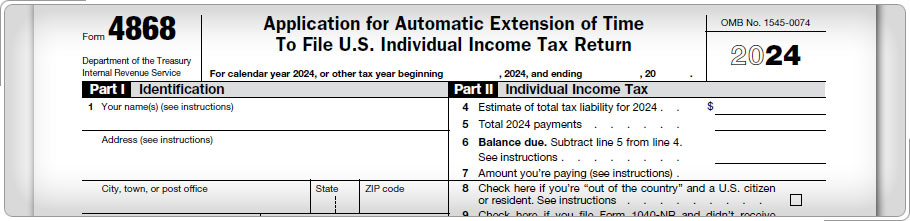

Case Study 1: Filing an ExtensionOne of Bernice's Forms W-2 was lost in the mail. She requested a copy from her former employer, but it did not arrive by the April due date for her return. She filed for an extension, calculated the amount of taxes owed based on her final pay stub from that employer, and paid the $243 that was due. When she finally received her Form W-2, she filed her return and reported the $243 on the applicable line on Form 1040, Schedule 3. Click here for an explanation. Taxpayers can get an automatic 6-month extension by submitting Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. This form extends the time to file until October 15. This is only an extension to file, not an extension to pay. If taxpayers do not pay their taxes due by the April due date of her return, they will owe interest and may be charged penalties. Refer to Form 4868 instructions, How To Make a Payment With Your Application.

|