Print the Taxpayer's Copy

Volunteer tax assistance sites use tax software to create and e-file tax returns. All taxpayers must receive a complete copy of their return before leaving. Follow the steps in Publication 4012, Finishing the Return tab, to prepare the taxpayer's copy. In general:

- Use the tax software to print the entire return, including all forms, schedules, and attachments, including any consent forms the taxpayer may have signed

- Make sure the taxpayer names and Social Security numbers are correct

- Assemble the taxpayer's copy:

- Start with Form 1040

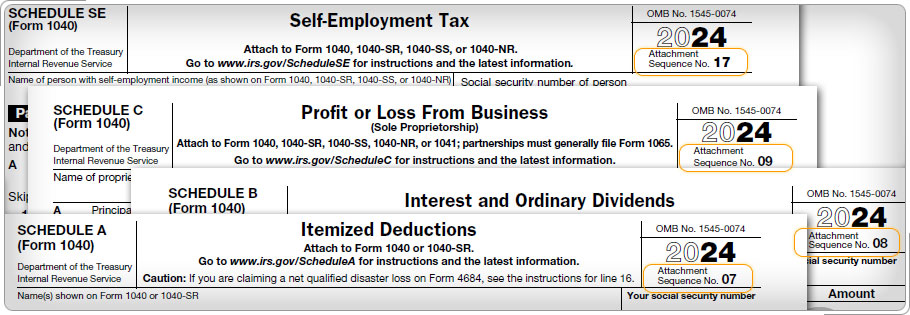

- Place each form, schedule, and attachment in numeric order,

based on the sequence number shown in the upper right corner

of the form

- Show the taxpayers the printed copy of the tax return, verifying once more the name, SSN, ITIN, address, filing status, dependents, income, expenses, deductions, credits, payments, and finally, tax refund or balance due