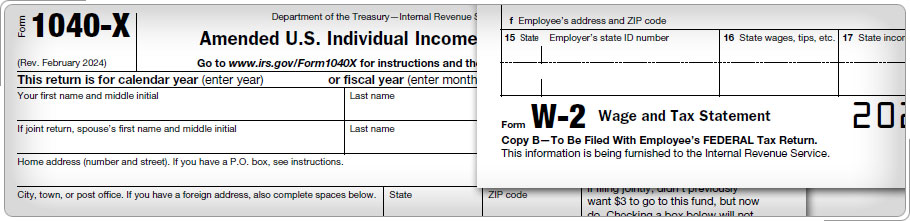

Case Study 1: Additional Forms/Changing InformationTwo weeks after Bernard's current year tax return was filed, he received another Form W-2 in the mail. The volunteer tax preparer reviewed Bernard's file to be sure the Form W-2 wasn't included in the original return. The volunteer then helped Bernard prepare Form 1040-X to include the additional Form W-2 on the current year return. Click here for an explanation. File an amended return if taxpayers received another Form W-2, a corrected Form W-2, or another income statement that was not reported on the original return.

|