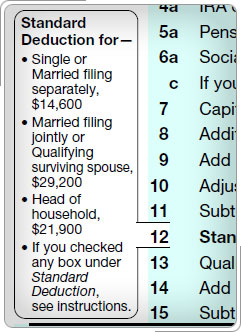

Standard DeductionThe standard deduction for taxpayers who do not itemize deductions on Form 1040, Schedule A, has increased. The standard deduction amounts for 2025 are:

Taxpayers who are 65 and Older or are BlindFor 2025, the additional standard deduction amounts for taxpayers who are 65 and older or blind are:

DependentsFor 2025, the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of (1) $1,350, or (2) the sum of $450 and the individual's earned income. Limitation on Deduction for State and Local, etc. Taxes (SALT)The following provision changed due to H.R. 1, One Big Beautiful Bill Act: Provides a temporary increase to the state and local tax (SALT) deduction limitation from $10,000 to $40,000 effective for calendar years that begin in 2025 and end before January 1, 2030. The applicable limitation amount (half the applicable limitation amount in the case of a married individual filing a separate return) in any taxable year beginning in calendar year 2025 is $40,000. The applicable limitation is adjusted for tax years beginning after 2025.

|