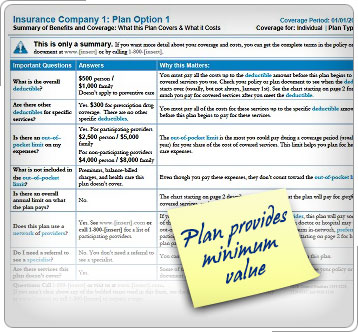

Case Study 2: Enrolled Family Members CoverageCedric is single and has no dependents. When enrolling through the Marketplace during open enrollment, Cedric was not eligible for employer-sponsored coverage. In August of the tax year, Cedric began a new job and became eligible for employer-sponsored coverage that is affordable and provides minimum value on September 1st. Since Cedric became eligible for employer-sponsored coverage on September 1st and the coverage was affordable and provides minimum value, he would usually be unable to claim a PTC for September and the other months he was eligible for the employer coverage. Click here for an explanation. Generally, a person who is eligible for employer-sponsored coverage is not eligible for a PTC for those months, even if he turns down the employer's coverage. A person may be eligible for a PTC despite an offer of employer coverage if the employer's coverage is unaffordable or fails to meet a minimum value standard (employers will provide employees with information concerning whether the minimum value standard is met). Cedric may be able to get a PTC for September if APTC was being paid for his Marketplace coverage, Cedric informed the Marketplace about his new coverage, and the Marketplace was unable to discontinue the APTC for September.

|