Case Study 1: Claiming the PTCBrandon is single with no dependents. When he enrolled through the Marketplace, Brandon was approved for APTC based on his projected household income. Brandon's Form 1095-A shows APTC of $1,486. Based on Brandon's actual modified AGI, he is eligible for a PTC of $500. Brandon's household income is at 310 percent of the FPL, so he is allowed a repayment limitation. Brandon must increase his tax liability by the lesser of the excess of his APTC over his PTC, $986, or the repayment limitation. Check the Repayment Caps for APTC chart in your Volunteer Resource Guide, Tab H.

|

Premium Tax Credit Workout

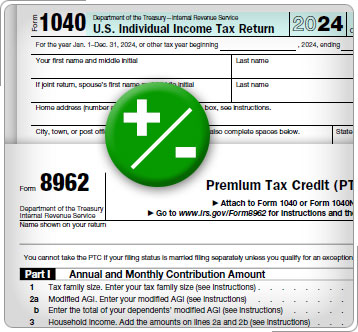

Claiming the Premium Tax Credit

Form 8962

Form 1095-A

Publication 4012: Premium Tax Credit