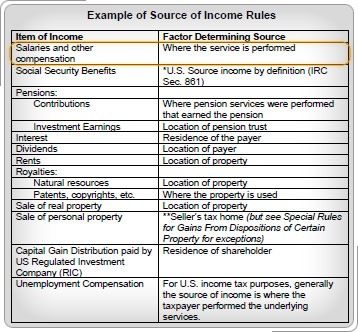

Salaries and Other CompensationWhere services are performedEarned income includes:

U.S. Armed ForcesIf a service member is a bona fide resident of Puerto Rico, their military service pay on active duty will be sourced in Puerto Rico, regardless of whether the services are performed in the United States, another territory, or a foreign country. However, if the service member is not a bona fide resident of Puerto Rico, their military service pay will be considered income from the United States, even if the services are performed in Puerto Rico. Unemployment CompensationFor U.S. income tax purposes, generally the source of income for unemployment compensation is where the taxpayer performed the underlying services.

|