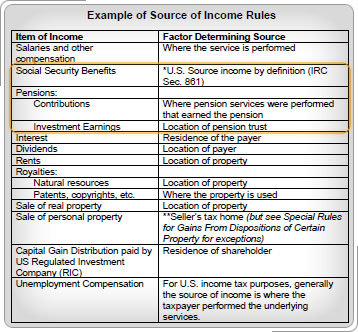

Interest Income and PensionsResidence of PayerThe residence of the payer determines the source of interest income. Interest can come from:

Puerto Rico residents who receive interest from U.S. bank accounts have U.S. source income. PensionsFor pension distributions attributable to contributions, the place where the services were performed that earned the pension is used to determine the source of pension distributions. For investment earnings on pension contributions, the location of the pension trust is used to determine the source of Investment earnings on pension contributions. ALERT: Taxpayers who receive income from private pensions for services rendered in Puerto Rico and the trust is in the United States must allocate the distribution between contributions and growth, so it is outside the scope of the program, unless the taxpayer provides these amounts. For additional information refer to the Revenue Procedure 2004-37. U.S. Social Security BenefitsSocial Security benefits are U.S. source income by definition (Internal Revenue Code Section 861). The taxable portion of Social Security benefits is included in the U.S. federal income tax return and it is not excluded by IRC Section 933.

|