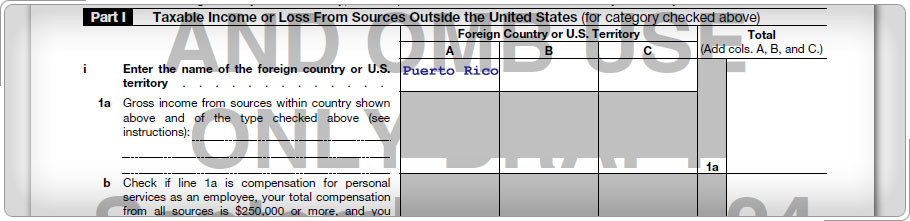

Part ITo calculate the maximum foreign tax credit that taxpayers can claim, compare their foreign income taxed by the U.S. with their total income taxed by the U.S. Use a separate column in Part I and a separate line in Part II to report income from each country or possession of the same category checked on boxes a through g. To complete Part I of Form 1116 for U.S. citizens who are residents of Puerto Rico and received Puerto Rico source income:

A U.S. government employee reports wages on Form 1116, line 1a. If all the services were performed in Puerto Rico, this information is obtained from Form W-2 line 1. Do not include the Cost Of Living Adjustments (COLA) or excluded income. Note: It is important to correctly separate the foreign income entered on Form 1116 from the total income on Form 1040. Income reported on line 1a must be included on Form 1040. But, Form 1040 may include other income that is not eligible for the foreign tax credit because it is U.S. source. For example, Social Security benefits or services performed in the United States.

|