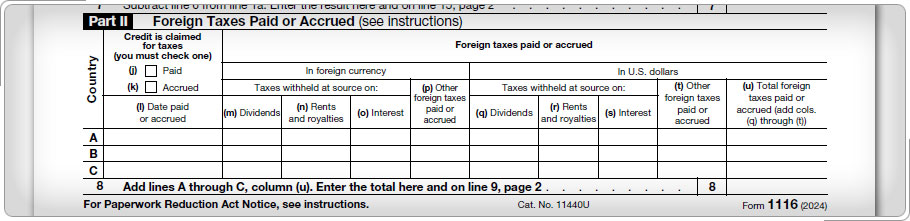

Part IIAmount of Qualified Foreign TaxesUse Form 1116, Part II, to establish the amount of qualified foreign taxes paid or accrued during the year. This table has directions for filling in each line in Part II.

Taxpayers, including cash basis taxpayers, can take the foreign tax credit in the tax year paid or accrued. Under the accrual method, Puerto Rico taxes are determined as of December 31 of the tax year. Most U.S. government employees who live in Puerto Rico use the accrual method to determine their foreign tax credit because their Puerto Rico tax liability is not calculated until they complete their Puerto Rico tax return after the end of the year.

|