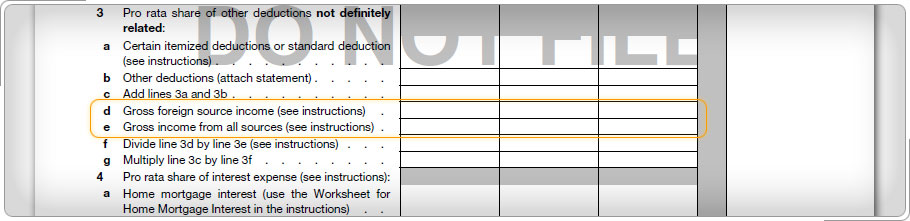

Part I (continued)Lines 3d and 3e: Gross Foreign Source Income and Gross IncomeWhen computing gross income, do not enter any excluded income (except Form 2555 Foreign Earned Income Exclusion) on lines 3d and 3e. On line 3d, enter gross foreign source income (Puerto Rico source income) that is taxable to the U.S. for the category of income checked at the top of Form 1116. On line 3e, enter gross income from all sources and all categories, both U.S. and foreign. If the taxpayer only has income sourced in Puerto Rico and is only completing Form 1116 for one category, line 3d and 3e will be the same.

|