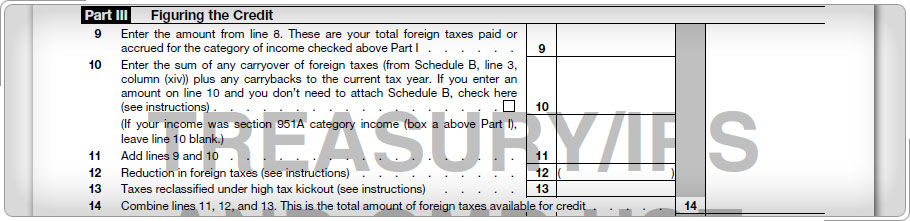

Part III (continued)Line 12: Reduction in Foreign TaxesOn Form 1116, Part II, all Puerto Rico taxes paid or accrued on both excluded and nonexcluded income may be shown when computing the credit. However, taxes paid on excluded income are not allowed as part of the foreign tax credit. Taxes allocated to the excluded Puerto Rico income should be included in Part III, line 12, as a reduction in foreign taxes. To find a taxpayer's reduction in foreign taxes, use this formula:

|