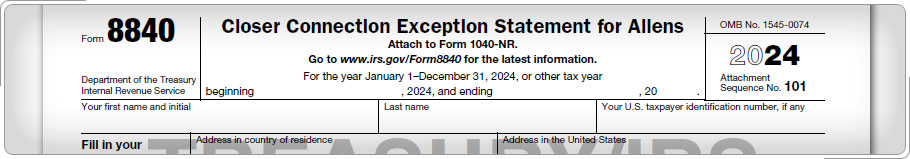

Closer Connection to Home Country (Information Purposes Only - Out of Scope)If a person can show a closer connection to a foreign country than to the U.S., it is also an exception to the substantial presence test. The person must file IRS Form 8840 and be able to show that they meet all of the following:

Form 8840 is Out of Scope for the VITA/TCE Foreign Student and Scholar program. Remember to refer taxpayers with tax situations outside of your scope of training, experience, and certification to your site coordinator and/or a professional tax preparer. Generally, students or scholars do not meet this test because they are considered to be in a trade or business in the U.S., thus establishing a closer connection to the United States.

|