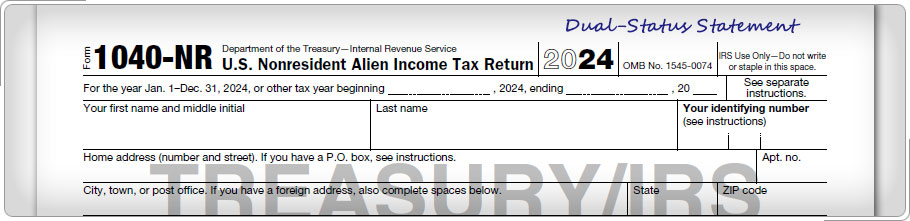

Dual-status Aliens — Residents (Out of Scope)You must file a paper Form 1040 if you are a dual-status tax-payer who becomes a resident during the year and who is a U.S. resident on the last day of the tax year. Enter "Dual-Status Return" across the top of the return. Attach a statement to your return to show the income for the part of the year you are a nonresident. You can use Form 1040-NR as the statement, but be sure to enter "Dual-Status Statement" across the top. Do not sign Form 1040-NR. If no payment is enclosed, the return is filed with the Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0215 U.S.A. If a payment is enclosed, the return is mailed to Internal Revenue Service, P.O. Box 1303, Charlotte, NC 28201-1303 U.S.A. A taxpayer who qualifies for, and wishes to file as a dual-status alien, does not meet the criteria for preparation at a VITA site. These returns and statements are Out of Scope for the VITA/TCE Foreign Student and Scholar program.

|