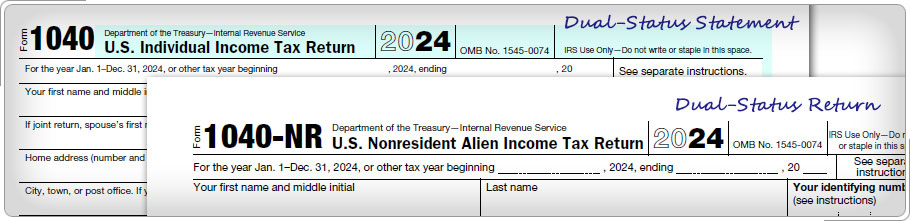

Dual-status Aliens — Nonresidents (Out of Scope)You must file a paper Form 1040-NR if you are a dual-status taxpayer who gives up residence in the United States during the year and who is not a U.S. resident on the last day of the tax year. Enter "Dual-Status Statement" across the top of the return. Attach a statement to your return to show the income for the part of the year you are a resident. You can use Form 1040 as the statement, but be sure to enter "Dual-Status Return" across the top. Do not sign Form 1040. If no payment is enclosed, the return is filed with the Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0215 U.S.A. If a payment is enclosed, the return is mailed to Internal Revenue Service, P.O. Box 1303, Charlotte, NC 28201-1303 U.S.A. Dual status may be available as a filing option, but it is Out of Scope for the VITA/TCE Foreign Student and Scholar program.

|