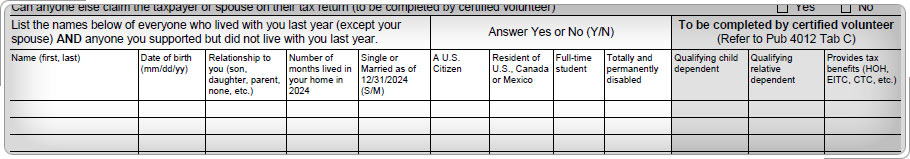

Intake/Interview & Quality Review SheetTaxpayers can claim either a qualifying child or a qualifying relative as a dependent on their return. Review the taxpayer's completed Form 13614-C, Intake/Interview & Quality Review Sheet, particularly Part II, Marital Status and Household Information. See the Volunteer Resource Guide, Dependents tab for interview tips that can provide helpful probing questions to use when interviewing the taxpayer. Click here to view Table 1, All Dependents, and Table 2, Qualifying Relative Dependents, from the Volunteer Resource Guide, Dependents tab. Be sure to add any information you learn to the Marital Status and Household Information section of the intake and interview sheet. Click here to review Form 13614-C, the Intake/Interview & Quality Review Sheet.

|

Dependents Workout

Workout Resources

Table 1: All Dependents and Table 2: Qualifying Relative Dependents