Case Study 1: Support TestSherrie's father received $2,700 from Social Security, but he put $300 of it in a savings account and spent only $2,400 for his own support. Sherrie spent $2,600 of her income for his support, so she has provided over half of his support. Click here for an explanation. To meet this test, the taxpayer must have provided more than 50% of the person's total support for the tax year.

|

Dependents Workout

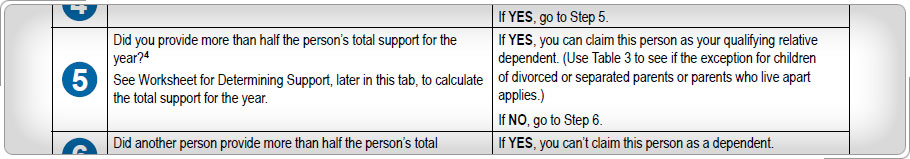

Qualifying Relative Tests

Pub 4012, Table 2: Qualifying Relative

Pub 4012, Worksheet for Determining Support