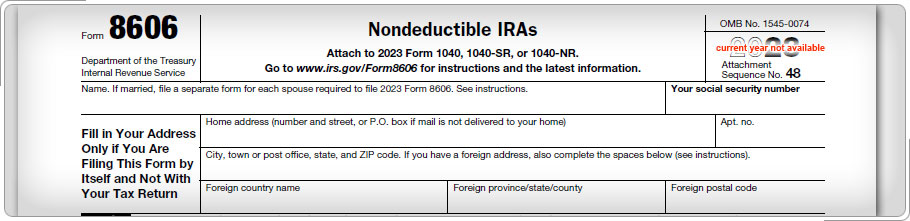

Case Study 2: Individual Retirement ArrangementsTess contributed $750 a year to a traditional IRA. She did not qualify to deduct her contributions from her income. This year Tess received her first distribution from the traditional IRA. She will pay income tax only on the part of the distribution from the traditional IRA that represents earnings on the contributions. She will use Form 8606, Nondeductible IRAs, to determine the taxable portion of her distribution. Tess should be referred to a professional tax preparer.

Click here for an explanation. Distributions from traditional IRAs are fully taxable unless nondeductible contributions have been made. See the Adjustments lesson for additional information. Form 8606, Nondeductible IRAs, is used to keep track of nondeductible contributions. The return is Out of Scope if the taxpayer needs to file Form 8606.

|

Income — Retirement Income Workout

Retirement Plan Distributions

Pub 4491, Retirement Income Lesson