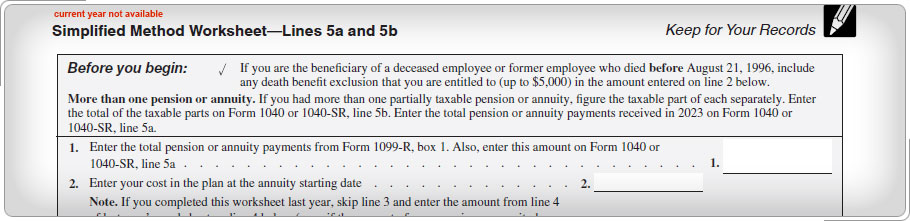

Case Study 3: Partially Taxable Pensions and Annuities Other than IRAsMelvin retired from a manufacturing plant. While he was working at the plant, his employer withheld money from each paycheck and sent it to the Engineer's Pension Fund. Melvin will receive a monthly pension payment for the rest of his life. Melvin will use the Simplified Method Worksheet to determine the tax-free part of monthly payments. Click here for an explanation. Using the Simplified Method Worksheet, you can figure the tax-free portion of each pension/annuity payment by dividing the taxpayer's cost in the contract by the total number of expected monthly payments. The table in the worksheet will help determine the number of monthly payments based on the taxpayer's age (or the combined ages if a joint and survivor annuity is elected) on the annuity start date. Taxpayer's cost basis ÷ Number of monthly payments = Monthly Tax-Free Portion. Refer to Instructions for 1040 (1040-SR), Worksheet A, Simplified Method Worksheet - Lines 5a and 5b.

|

Income — Retirement Income Workout

Taxable Pensions and Annuities

Pub 4491, Retirement Income Lesson

Simplified Method Worksheet