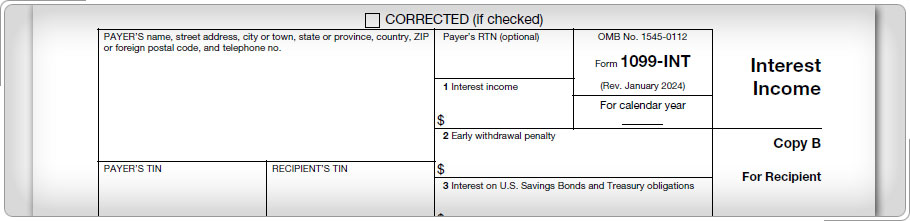

Case Study 1: Form 1099-INT or Form 1099-OIDGloria withdrew $5000 from a one-year, deferred-interest certificate of deposit in the current tax year. She had to pay a penalty of three months' interest and claim the penalty amount as an adjustment to income. Click here for an explanation. Taxpayers can adjust their income by deducting penalties they paid for withdrawing funds from a deferred interest account before maturity. Ask if the taxpayer and/or spouse made any early withdrawals during the tax year. If so, ask to see Form 1099-INT, Interest Income, or Form 1099-OID, Original Issue Discount, documenting the penalty.

|