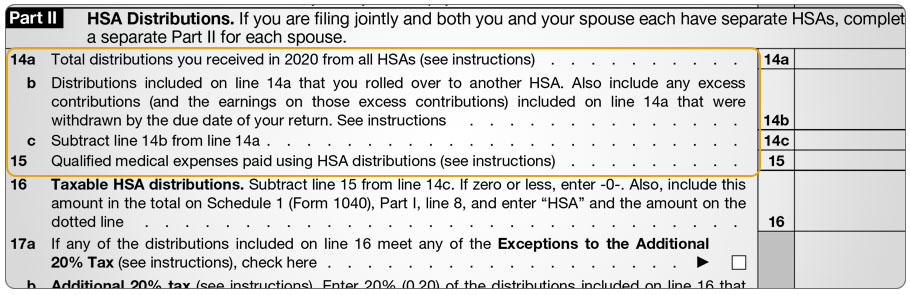

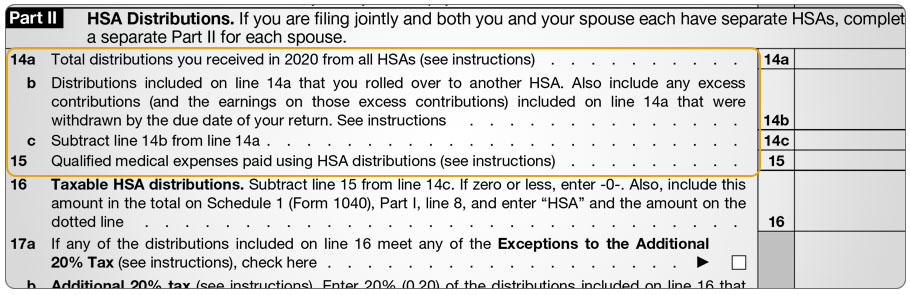

Unreimbursed Medical ExpensesHSA distributions included in income are subject to an additional 20% tax unless the account beneficiary:

|

Unreimbursed Medical ExpensesHSA distributions included in income are subject to an additional 20% tax unless the account beneficiary:

|