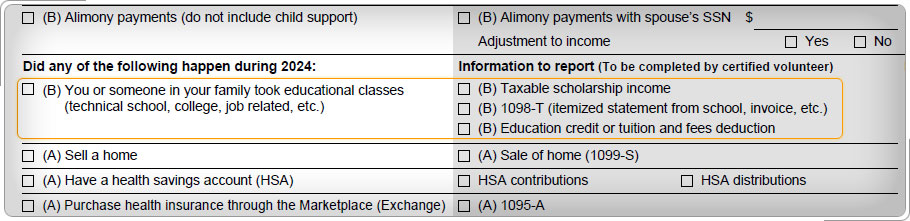

Intake/Interview & Quality Review SheetConduct a probing interview based on the taxpayer's intake and interview sheet, On the intake and interview sheet, make sure that the appropriate box is checked to indicate that the taxpayer had education expenses. During the interview, ask taxpayers if they are aware of the education credits and give a brief description of each. Next, gather information to determine if any credits can be claimed. If a taxpayer paid expenses for education, ask if any of the following disqualifying conditions apply:

Note anything unusual that the quality reviewer may need to know when reviewing this part of the tax return. For example, you could note if some expenses were paid with a nontaxable scholarship.

|