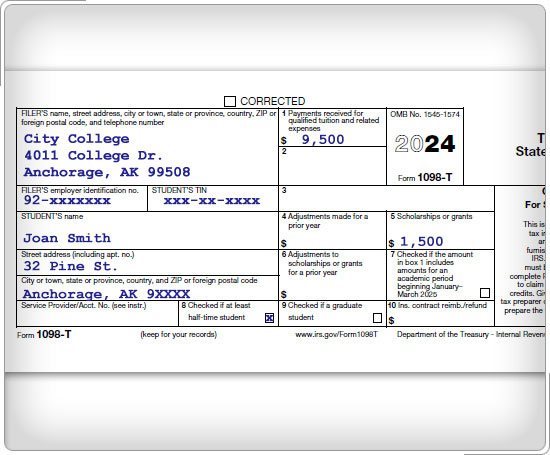

Case Study 3: Excluded AmountsJoan Smith received Form 1098-T from the college she attends. It shows her tuition was $9,500 and that she received a $1,500 scholarship. She had no other scholarships or nontaxable payments. What is her maximum qualifying expense for the education credit? Click here for an explanation. Taxpayers who pay qualified higher education expenses with tax-free parts of scholarships and fellowships cannot claim a credit for those amounts. Qualified expenses must be reduced by the amount of any tax-free educational assistance taxpayers receive. Her maximum qualifying expenses for the education credit would be $8,000 ($9,500 - $1,500). However, it may benefit the taxpayer to choose to include otherwise tax-free scholarships or fellowship grants in income. This may increase the education credit and lower the total tax or increase the refund.

|