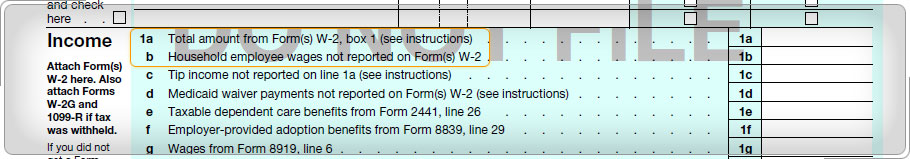

Case Study 1: Household Employee IncomeEllis had several part-time jobs during the tax year, one of which was providing handyman and gardening services for Mrs. Fulton, a retired widow. Ellis's total earned income from all his jobs was $12,500, including the $750 he earned as a household employee for Mrs. Fulton. Ellis received Forms W-2 from all his employers except Mrs. Fulton. How would you complete the wages line of Ellis's Form 1040? Click here for an explanation. Ellis's total earned income was $12,500, $750 is shown on the household employee line on the return.

|

Earned Income Credit (EIC) Workout

Qualifying for the EIC

Summary of EIC Eligibility Requirements