Case Study 2: Tests for Qualifying ChildrenRobyn Smith is 25 years old. She and her 2-year-old child, Aiden, lived with Robyn's mother all year. Aiden has a valid SSN. Following are Robyn's responses to the questions in the EIC with a Qualifying Child Chart in the Volunteer Resource Guide, Tab I, Earned Income Credit:

What does the tax preparer do next to determine if Aiden is a qualifying child for EIC? Click here for an explanation. Because the taxpayer, Robyn, does not know the answer to Step 6, "Is the child a qualifying child of another person?", the tax preparer must ask probing questions to clarify the child's status. For example, if you ask who else lived in the house that is related to Aiden, Robyn would tell you that her mother also lives with them. The tax preparer then needs to go through the steps to see if Aiden can be a qualifying child for Robyn's mother and then review the Qualifying Child of More than One Person rules.

|

Earned Income Credit (EIC) Workout

Rules for Taxpayers with Qualifying Children

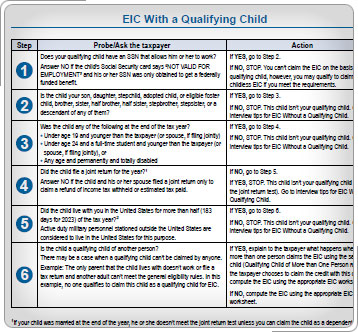

EIC With a Qualifying Child Chart

Qualifying Child of More Than One Person